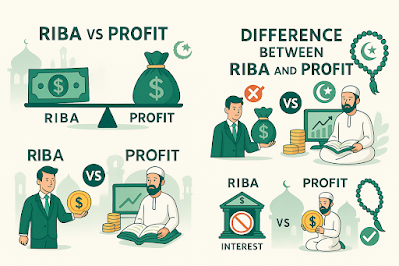

The most valuable distinction between haram interest and halal earnings.

Riba (interest) and profit (halal earnings) are the two words that bring confusion to Muslims in the context of the world of finance. Although both of these may entail growth in money, the nature of such and effects are totally different in particular against the backdrop of Islamic Shariah.

How can riba be strictly forbidden and profit be absolutely halal in Islam, let us look at that.

What is Riba?

Riba refers to interest or usury- an overpayment given on an interest or debt. It is securely established and not tied to any danger or hard work.

> 🕋 Qur'an(2:275):

Allah has not made riba lawful but made trade lawful.

Riba may be of various forms:

A lender who lends money of Rs. 10,000 and requires payment of Rs. 12,000

Late payment of interest added on top of it

Fixed-Return Bank savings accounts

Riba is exorbitant, because, one party gains without risk, whereas the borrower is burdened.

What is Profit?

Profit in Islam is a halal gain received in a business, trade or investment in which:

Sharing of risk occurs

Labor or currency is traded

There is no guarantees of the return

Profit will happen when:

You purchase goods at Rs 500 and sell at Rs 700

You invest in a business and get profits according to the performance

You offer a service and you have a fee that is charged

Profit is made through risk, sweat, and equitability: making it halal.

Key Differences Riba vs Profit

Aspect Riba (Interest) Profit (Halal Earning)

Permission/prohibition Prohibited (Haram) Permissible (Halal)

Nature Fixed return Variable return

Risk Sharing Entire risk is borne by the borrower Sharing of risk

Outcome Not obtained by labor or trade Obtained by labor, business, or trade

Example Bank loans at 10 percent interest You invest in a store and make a share

Islamic Viewpoint Proclaimed war against Allah and Prophet Promoted Islamic trade

What makes Riba Haram in Islam?

Riba brings about social unjust and inequality of the rich and the poor as well as exploitation. This enriches the rich as they do not need to put efforts on it, and the poor pay higher in the long-term. It kills economic balance and enhances poverty.

Islam desires a society in which wealth flows, risk is spread and nobody is unjustly overburdened.

Profit is made by:

Effort

Value creation

Risk-taking

Islam promotes moral business and value trade. This is why the Prophet Muhammad (��хов) himself was a trader his self- many of the Sahaba were successful businessmen.

Misunderstanding Clarification

Riba is any additional money This is not true, profit is permissible when earned honestly

Bank savings = halal A majority of conventional savings are riba

Riba is installment with markup Not necessarily, it can be fixed and agreed at the time of sale, it can be halal

Islamic Alternatives of Riba-Based Finance

Mudarabah- profit sharing investment

Murabaha -Markup sale (disclosed)

Musharakah Joint venture/partnership

Ijara - interest free leasing

They are used in Islamic banking as alternatives of interest.

📚 Conclusion

Riba and profit might appear to be the same to some people, but the Islamic religion has made a major distinction between exploitation (haram) and reasonable gain (halal).

Riba is a curse - Profit is a blessing.

As Muslims we must shun riba as much as possible and find ways to trade, earn and invest in halal ways. It is not financial growth alone but barakah in wealth which can only be achieved with halal income.

0 Comments